How to Insure Jewelry The Right Way

- alex mark

- Jul 9, 2025

- 12 min read

If you want to properly insure your jewelry, you’ll need to do more than just rely on your standard homeowners policy. The solution is usually a special add-on, often called a rider or a floater, or better yet, a separate, dedicated jewelry insurance policy. Most standard plans offer shockingly little coverage for valuables, making this extra protection a must-have for anything valuable.

Why Your Jewelry Needs Its Own Insurance Policy

It's a common—and often costly—misconception that your homeowners or renters insurance has your jewelry covered. The truth is, these policies are built to protect the big stuff: your house itself and its general contents. They simply aren't designed for high-value, portable items like an engagement ring, a family heirloom, or a luxury watch.

Most standard policies have surprisingly low payout limits for jewelry. We're often talking about a cap of just $1,000 to $2,500 for your entire collection. Imagine losing several pieces in a burglary only to find out you’ll get back just a fraction of their actual worth. On top of that, basic policies typically only cover a narrow list of "named perils," like theft from your home or a fire.

Key Takeaway: Relying on a standard homeowners policy for your fine jewelry is like using a bike lock to secure a luxury car. It offers a false sense of security while leaving your most precious assets exposed to significant financial risk.

Common Gaps in Standard Coverage

The real devil is in the details—specifically, what standard insurance doesn't cover. These are the gaps that leave your most cherished pieces completely vulnerable:

Mysterious Disappearance: This is a big one. What happens if a diamond pops out of its setting while you're out, or a beloved necklace simply vanishes? Standard policies almost never cover this kind of unexplained, accidental loss.

Accidental Damage: You accidentally chip a gemstone on a countertop or snag and break the band of your ring. Under a basic plan, you're almost certainly paying for that repair out of your own pocket.

Limited Perils: Coverage is often strictly limited to specific events, like a break-in at your house. It usually won’t help you if your ring is lost on vacation or damaged while you're wearing it.

Jewelry isn't just a financial asset; it carries deep sentimental value. Thinking about if jewelry is a good investment can really drive home the importance of protecting its monetary worth. More and more people are realizing this, which is why the global jewelry insurance market is projected to jump from $5 billion in 2025 to nearly $9 billion by 2033. You can dig into more of this data on the jewelry insurance market at Data Insights Market.

Ultimately, a dedicated policy is designed to close these critical gaps and give you genuine peace of mind.

Securing an Appraisal That Insurers Trust

Your first move is to find a qualified, independent appraiser. The key word here is independent. You'll want to avoid using the same jeweler who sold you the piece, as an insurer might see that as a conflict of interest.

Look for someone with solid credentials from respected industry organizations. Certifications from the Gemological Institute of America (GIA) or the American Society of Appraisers (ASA) are the gold standard. These groups ensure their members have gone through rigorous training and follow a strict code of ethics, which gives their assessment real weight with insurers.

What to Look for in an Appraisal Report

A proper appraisal isn't just a number on a letterhead. It’s a detailed, multi-page document that gives the insurance company a complete and verifiable picture of the item they're protecting. If the report is flimsy, your policy could be rejected outright, or worse, a future claim could be denied.

To be considered legitimate by an insurance provider, your appraisal report needs a few key things:

A Detailed Description: This should go beyond "gold ring." A good description will specify the piece type (like "solitaire engagement ring"), the metal and its weight (e.g., "platinum, 3.4 dwt"), and any unique stamps or markings.

Gemstone Specifications: For a diamond, this means the full story of the 4Cs—Cut, Color, Clarity, and Carat weight. For other stones, it should detail the type, dimensions, shape, and overall quality.

High-Quality Photographs: You'll need clear, well-lit photos from several different angles. These are essential for identification.

Stated Value: This is the appraiser's official determination of the retail replacement value—what it would cost to buy a new, identical piece in today's market.

This thorough documentation is the bedrock of your insurance policy. Think of it as the official record that proves your jewelry's existence and value, ensuring you'll be properly compensated if it's ever lost, stolen, or damaged.

Choosing Your Jewelry Insurance Coverage

With your appraisal in hand, it's time to decide how you'll actually insure your jewelry. This isn't a one-size-fits-all situation. You've got two main paths to go down, and the one you choose can make a world of difference if you ever need to file a claim.

Most people first think of adding a rider—sometimes called a floater or a scheduled personal property endorsement—to their existing homeowners or renters insurance. It’s a pretty straightforward process; you just call your agent and add it on. While this is certainly convenient, it's not always the most comprehensive choice.

The other route is to get a standalone policy from an insurance company that focuses only on jewelry. Think of these as the specialists. Their policies are built from the ground up for fine jewelry, covering nuances that a general homeowners policy just wasn't designed to handle.

The Homeowners Rider vs. a Standalone Policy

So, what’s the real difference? A homeowners rider is basically an extension of your current policy. It carves out an exception for a specific high-value item, getting you around the typically low coverage limits for jewelry. It's a solid upgrade from having no specific coverage at all.

However, a standalone policy is where you find the most comprehensive protection. These policies often cover scenarios that riders won't, like "mysterious disappearance." That’s the industry term for that heart-stopping moment when you look down and your diamond is simply gone from its setting, with no evidence of theft. Standalone policies also usually offer automatic worldwide coverage, so you’re protected no matter where your travels take you.

A key thing to remember is that a claim against a homeowners rider can affect your entire home insurance policy. It might raise your premium or even jeopardize your renewal. A claim on a standalone jewelry policy, on the other hand, is self-contained and won't touch your home or auto insurance.

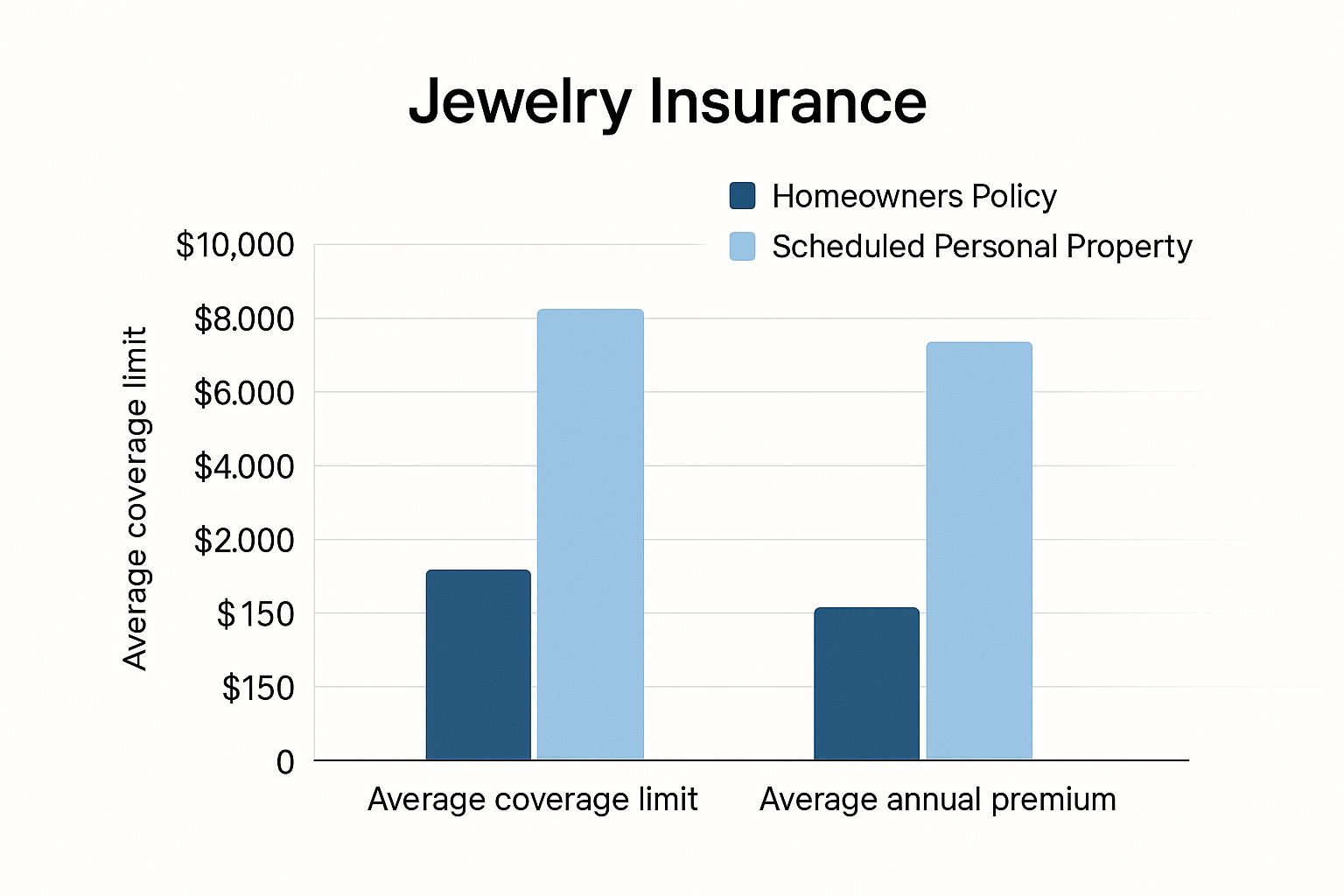

This infographic breaks down the typical costs and coverage you can expect from each option.

As you can see, a standalone policy might have a higher annual premium, but it often provides significantly more coverage. This makes it a much better fit for truly valuable pieces.

To help you visualize the differences, here’s a direct comparison of the two main ways to insure your valuables. This should help you decide which path makes the most sense for you.

Homeowners Rider vs. Standalone Jewelry Policy

Feature | Homeowners Rider/Floater | Standalone Jewelry Policy |

|---|---|---|

Coverage Scope | Often covers specific, named perils like theft and fire. | Typically "all-risk" coverage, including loss and mysterious disappearance. |

Deductible | Usually subject to your homeowner's policy deductible or a separate one. | Often has $0 deductible options available. |

Claim Impact | A claim can increase your entire homeowners insurance premium. | A claim only affects the jewelry policy; your other insurance is untouched. |

Claims Process | Handled by general adjusters, may push for a cash settlement. | Handled by jewelry specialists who work to repair/replace with like kind and quality. |

Replacement | May require you to use their preferred (and cheaper) jewelers. | You can usually return to your original jeweler for replacement or repair. |

Worldwide Coverage | May have limitations or require you to notify the insurer before travel. | Coverage is typically automatic and worldwide. |

Ultimately, choosing the right policy boils down to the value of your jewelry and your own peace of mind.

Making the Right Call for Your Valuables

The best choice really depends on what you're trying to protect. If you have a lovely piece worth a few thousand dollars, a rider could be perfectly adequate. But when we're talking about a $15,000 engagement ring or an irreplaceable heirloom, the robust protection of a dedicated standalone policy from a provider like Jewelers Mutual is often the smartest move.

Here are a few final points to weigh:

Deductibles: Many standalone policies come with a $0 deductible. This means if your ring is lost or stolen, you pay nothing out of pocket to have it replaced. Riders, in contrast, almost always have a deductible you'll need to meet.

Claims Expertise: With a specialty insurer, your claim is handled by someone who knows jewelry inside and out. They understand the difference between GIA-certified diamonds and can work directly with your jeweler. That's a much smoother experience than dealing with a general adjuster.

Breadth of Coverage: The "all-risk" coverage common with standalone policies is a huge advantage. It protects you against a much wider range of potential losses, from accidental damage to outright disappearance.

Navigating the Application and Required Paperwork

You’ve got a solid appraisal in hand and you know which type of policy you want. Now comes the final hurdle: the paperwork. It’s easy to think of this as just another form to fill out, but I can't stress this enough—getting the application right is absolutely critical. A simple slip-up here can cause delays in your coverage or, worse, create major headaches if you ever need to file a claim.

Before you even touch a pen or keyboard, get your documents organized. Having everything ready beforehand turns a tedious task into a smooth process.

You'll need:

The Full Appraisal Report: This is non-negotiable. It's the official proof of value and the detailed description your insurer relies on.

High-Quality Photos: Snap clear, well-lit pictures of your jewelry from a few different angles. These photos act as visual records of the piece’s condition and unique characteristics.

The Original Sales Receipt: While it can't replace a formal appraisal, the original receipt is great supporting documentation that confirms the purchase details.

Getting the Details Right

When you sit down to fill out the application, your motto should be precision. Every single detail you enter on that form needs to perfectly mirror what's on your appraisal. I’m talking about everything from the gold karat and weight down to the exact cut, color, and clarity of the tiniest accent stone.

Even a small discrepancy can raise a red flag with an underwriter and slow things down.

Think of your insurance application like a legal contract—because it is. Absolute honesty and meticulous accuracy are your best allies in building a policy that will actually come through for you when you need it.

The good news is that technology is making this part of the process much more efficient. Many insurers are now using sophisticated tools, including AI, to process applications and assess an item’s value and risk profile more accurately. This often means a faster, smoother experience for the customer. You can read more about how the industry is evolving in this market report from Verified Market Reports.

Ultimately, your goal is to create an ironclad record of your jewelry's existence and value. By taking the time to do this right, you're not just buying a policy; you're building a foundation of security and genuine peace of mind.

What to Do When You Need to File a Jewelry Insurance Claim

It’s a heart-stopping moment—the second you realize a precious piece of jewelry is gone or damaged. The emotional blow is real, but your financial recovery depends on what you do next. The first step? Take a breath, and then get organized.

If you're dealing with theft, your very first move must be to file a police report. Don't wait. Insurance companies won’t even begin processing a theft claim without a police report number, and filing one immediately shows them you’re taking the situation seriously. That report becomes the cornerstone of your claim.

With the police report in hand (or at least the report number), your next call is to your insurance provider. Let them know you need to open a claim and have your policy number ready. They’ll walk you through their specific steps and tell you exactly what documents you’ll need to send over.

Getting Your Paperwork in Order

The smoother you want this process to be, the more organized your documentation needs to be. Think of it as building a case—you need to provide undeniable proof of what you owned and what it was worth.

Here’s a quick checklist of what your insurer will likely ask for:

The police report number (for any theft)

Your original appraisal document

Clear, high-quality photos of the item

The original sales receipt, if you can find it

A detailed, written account of exactly what happened—when, where, and how the piece was lost, stolen, or damaged.

This is precisely why we stress keeping meticulous records from day one. The strength of your claim really does come down to the quality of the documentation you’ve kept.

Your goal is to give the insurer a complete and undeniable record that proves your loss. The more thorough you are, the faster they can process your claim and get you to a resolution.

This might sound daunting, but it's a well-trodden path, especially in certain parts of the world. For example, North America makes up about 40% of the entire global jewelry insurance market, largely because there’s a strong culture of protecting valuable assets. You can find more details on this in a report on the jewelry insurance market at ReportsnMarkets.com.

Once you’ve submitted everything, the insurance company will begin its investigation. This might involve follow-up questions or even a call to the jeweler who sold or appraised the piece. Afterward, they’ll present you with your options based on your policy: repair, replacement, or a cash payout.

If your piece was damaged and gets repaired, keeping it in top shape is key. We have some great tips on how to clean jewelry at home to help maintain its beauty.

Keeping Your Coverage Current and Effective

Getting your jewelry insured is a fantastic first step, but it’s not a "set it and forget it" task. Think of your policy as a living document that needs a check-up every so often to stay effective. The markets for precious metals and gemstones are always fluctuating. A ring that was valued at $10,000 a few years back might easily cost $12,000 to replace today.

This is exactly why regular reappraisals are non-negotiable. For your insurance to do its job, the value on paper has to match the value in the real world. A good rule I always follow is to get high-value pieces reappraised every two to three years. It’s a simple but critical step to ensure your coverage limit is actually high enough to replace what you lost.

Updating Your Policy and Protecting Your Pieces

Life changes, and so does your jewelry collection. It's so important to keep your insurance provider in the loop with any updates.

For instance, did you have a ring resized or upgrade the center stone in your engagement ring? You’ll want to let your insurer know. Any modification can change an item’s value, and your policy needs to reflect the piece you actually own now. The same goes for any new heirlooms or gifts you receive—never assume they're automatically covered.

My advice? Storing your jewelry securely is more than just common sense—it can sometimes even lower your premiums. Insurers love to see that you’re proactive about risk, whether that means using a quality home safe or a bank's safe deposit box for pieces you don't wear every day.

Finally, proper maintenance is just as much a part of protecting your investment as insurance is. For some great, practical advice on daily upkeep, check out our guide on jewelry care tips to keep your pieces sparkling. By staying on top of these things, you can rest easy knowing your insurance will be there for you when you need it most.

Of course. Here is the rewritten section, crafted to sound like it's coming from an experienced human expert.

Your Top Jewelry Insurance Questions Answered

Once you’ve got a handle on the basics, a few specific questions almost always pop up. I hear these from clients all the time, so let's walk through them to make sure you feel completely confident in your decisions.

So, What's This Going to Cost Me?

This is usually the first thing people ask, and for good reason! A good rule of thumb is to expect your annual premium to be about 1% to 2% of your jewelry's total appraised value.

Let's put that into perspective. If you have a $10,000 engagement ring, you’re looking at a yearly cost of around $100 to $200. It's a surprisingly small price for some serious peace of mind.

Do I Really Need to Get My Jewelry Reappraised?

Yes, and this is a big one. Think of it this way: the price of gold, platinum, and diamonds isn't static. It fluctuates. Getting your jewelry reappraised every two to three years is just smart practice. It ensures your coverage actually reflects what it would cost to replace that piece today, not what it was worth years ago.

Here’s a critical piece of advice: always insist on a policy that offers replacement value. This means the insurer will pay to replace your lost or damaged item with a new one of similar kind and quality. The alternative, actual cash value, only pays you what the item is worth after depreciation—which is always less. You want to be made whole, and replacement value is how you do it.

At Panther De Luxe Shop, we believe every beautiful piece deserves protection. Explore our collections of timeless jewelry perfect for any occasion at Panther De Luxe Shop.

Comments