Investing Insights: is gold jewelry a good investment - A Clear Guide

- Luke Zucco

- Jan 19

- 13 min read

So, is gold jewelry actually a good investment?

The short answer is yes, but it’s not as simple as buying a gold bar and watching its value rise. Think of gold jewelry as a hybrid asset—it’s part financial security, part wearable art. Its value is a blend of the intrinsic worth of the gold and the artistic value baked into its craftsmanship.

So Is Gold Jewelry a Good Investment

Unlike pure gold bullion, where the price is driven solely by weight and purity, jewelry mixes its commodity value with personal expression. This duality is both its greatest strength and its most complex feature. You get to enjoy wearing a beautiful necklace or ring, but its potential as an investment hinges on more than just the daily spot price of gold.

This guide will break down what really goes into a piece’s price tag, stack it up against other gold assets, and give you practical tips for buying smart. The goal is to help you blend your personal style with a sound financial strategy, turning what feels like a luxury purchase into a lasting asset.

Understanding the Market Potential

The global appetite for gold jewelry is strong and growing, which is great news for its long-term appreciation. The market was valued at around USD 219.4 billion in 2024 and is expected to climb to USD 304.2 billion by 2030.

That’s a solid compound annual growth rate (CAGR) of 5.6%, proving its stable demand and investment appeal.

This steady expansion is fueled by both deep-rooted cultural traditions and gold’s classic role as a tangible store of value. For an investor, this market data suggests that well-chosen pieces aren't just beautiful—they're backed by pretty strong economic fundamentals.

A key advantage of gold jewelry is its dual purpose. It serves as both a wearable piece of art and a tangible asset that can act as a hedge against inflation and economic uncertainty.

Calculating Your Potential Return

Ultimately, to know if gold jewelry is a smart move for your portfolio, you need to understand how to calculate return on investment while factoring in all the extra costs and potential gains. This means looking beyond the initial price tag to consider:

The premium: This is the markup you pay for craftsmanship, brand name, and retail costs. It can be significant.

Liquidity: How easily can you sell the piece for a fair price when you’re ready? Some pieces are much easier to liquidate than others.

Long-term value: What’s the potential for appreciation? This depends on both the future price of gold and the item's unique qualities.

To simplify these considerations, the table below provides a quick overview of what to weigh when deciding if gold jewelry fits your investment goals.

Gold Jewelry Investment At a Glance

Investment Factor | Key Consideration |

|---|---|

Primary Value Driver | A mix of gold's spot price and the item's artistic and brand value. |

Purchase Cost | Includes a premium for craftsmanship, which can be 20% to 300% over melt value. |

Liquidity | Generally lower than gold bullion; resale value depends heavily on the buyer. |

Appreciation Potential | Can appreciate due to rising gold prices, brand recognition, or becoming a rare vintage piece. |

Practical Use | High. It's a wearable asset you can enjoy every day. |

Best For... | Investors who appreciate both the aesthetic and financial value and have a long-term outlook. |

In short, gold jewelry isn't just a simple commodity trade. It’s a nuanced investment that requires you to appreciate its artistic side just as much as its financial one.

Understanding What You're Really Paying For

Ever looked at a gold necklace and wondered why it costs so much more than its simple weight in gold? It’s a great question. Buying gold jewelry is a bit like going out for a gourmet meal—you aren't just paying for the raw ingredients. The final price tag is a complex recipe, and each ingredient adds to the total.

The journey from a chunk of raw gold to a sparkling piece in a display case adds several layers of cost and value. Getting a handle on these layers is the first step in figuring out if gold jewelry is the right investment for you. Let's break down what actually goes into that price tag.

Melt Value Versus Market Value

At its very core, every piece of gold jewelry has what’s called an intrinsic or melt value. This is simply the base price of the pure gold in the item, calculated from its weight and the day’s spot price of gold. Think of it as the raw, stripped-down commodity value of the metal itself.

But you never just pay the melt value. The price you see in the store is the market value, and it includes a significant markup. This premium covers everything it takes to transform that raw gold into a finished piece you can wear.

Think of it this way: The melt value is the cost of the flour, sugar, and eggs for a cake. The market value is the price of the finished, beautifully decorated cake from a famous bakery. That extra cost covers the baker's skill, the unique recipe, and the shop's rent.

Breaking Down the Premium

The markup on gold jewelry isn't just random; it reflects real costs—some tangible, some not—that go into creating the final piece. Knowing what they are helps you see an item's true potential as an investment.

Here are the key things you’re paying for in that premium:

Labor and Craftsmanship: This is all about the skill of the artisans who design, cast, set, and polish the piece. A handcrafted ring from a master goldsmith will naturally have a higher labor cost than a mass-produced chain that rolled off an assembly line.

Designer and Brand Name: A piece from a big-name luxury brand like Cartier or Tiffany & Co. comes with its own premium. You're paying for the brand's reputation, design legacy, and the perception of quality, which can add a huge amount to the value.

Retailer Overhead: This covers the costs of running the jewelry store itself—things like rent for a prime location, employee salaries, marketing, and security. All these operational expenses are baked into the final price of every item.

Purity (Karat): The karat tells you how much pure gold is in the alloy. While a higher karat means more raw gold value, lower karats like 14K or 10K are often used to make the jewelry more durable for everyday wear. For a closer look at what this means, check out our guide on what percent of gold is in 10k jewelry.

At the end of the day, the investment side of your jewelry is tied to how gold itself performs on the market, and historically, it’s been a strong performer. Gold prices hit several record highs in 2024, with total demand reaching a staggering 4,974 tonnes. With many forecasts predicting more increases, the intrinsic value of your piece has a solid foundation for growth. You can explore more about gold jewelry market trends and forecasts on MarketResearch.com.

How Jewelry Stacks Up Against Other Gold Investments

So, is gold jewelry a smart investment? To answer that, you have to look beyond the jewelry counter and see how it really compares to other ways of owning gold. A beautiful necklace and a solid gold bar might be made of the same precious metal, but they behave very differently as assets.

Each form of gold—whether it's jewelry, bullion, ETFs, or mining stocks—has its own unique playbook. Understanding where each one shines (and where it doesn't) is the key to picking the right one for your goals. You wouldn't use a race car for a grocery run, and you wouldn't pick gold stocks if what you really want is something tangible you can actually hold.

Let's break down the options to see where jewelry fits in.

The Purest Play: Gold Bullion

Gold bullion, which comes in the form of bars and coins, is the most direct way to invest in gold. Its value is tied almost entirely to the live spot price of gold, plus a tiny premium to cover the cost of minting it. Think of it as owning the raw ingredient in its purest investment form.

The upside? Bullion is highly liquid, meaning it’s easy to buy and sell at a price very close to the market rate. It’s also a physical asset you can hold in your hand, giving you a sense of security that digital assets just can't match.

The downside? The biggest headache is storage. You'll need a secure spot like a home safe or a bank's safe deposit box, which adds to your overall cost. And let's be honest, you can't exactly wear a gold bar out to dinner.

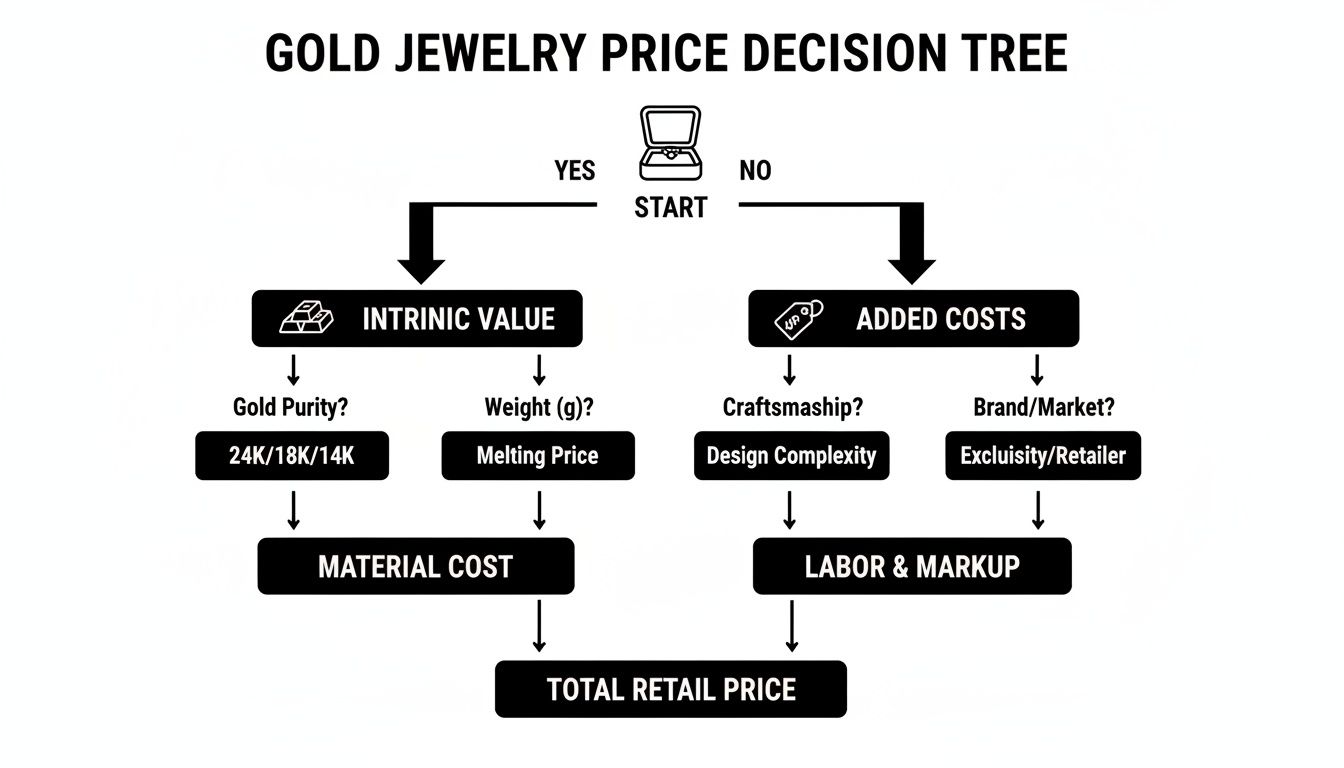

This flowchart shows you exactly what goes into the price tag of a piece of gold jewelry, separating its raw metal value from all the other costs piled on top.

As you can see, the gold itself is just the foundation. A huge chunk of the final price comes from labor, branding, and the retailer's markup.

Digital Gold: ETFs and Mining Stocks

If you want to bet on gold's price without the hassle of storing physical metal, Gold Exchange-Traded Funds (ETFs) and mining stocks are your go-to options. An ETF is a fund that tracks the price of gold, letting you buy and sell shares on the stock market. Mining stocks, on the other hand, are shares in the companies that actually pull gold out of the ground.

These digital options offer maximum convenience, but they come with their own set of risks. You never own the physical metal, so you miss out on the tangible, safe-haven benefit. Worse, mining stocks are tied to company performance—things like bad management or operational problems can tank your stock’s value, even if the price of gold is soaring.

Gold jewelry occupies a unique middle ground. It's a tangible, physical asset like bullion but also a consumer good with artistic and sentimental value, something ETFs can never offer.

Gold Investment Options Compared

To make the right call, it helps to see how these options stack up side-by-side. The table below breaks down the key differences in liquidity, costs, storage, and what kind of value you’re really getting.

Investment Type | Liquidity | Premium Over Spot | Storage/Holding | Additional Value |

|---|---|---|---|---|

Gold Jewelry | Moderate to Low | High (20% to 300%+) | Personal; requires insurance | Wearable, aesthetic, sentimental, heirloom potential |

Gold Bullion | High | Low (1% to 5%) | Requires secure vault or safe | Purely financial; tangible security |

Gold ETFs | Very High | Very Low (brokerage fees) | Digital; held in a brokerage account | No tangible value; tracks gold price |

Mining Stocks | Very High | N/A | Digital; held in a brokerage account | Potential for dividends and growth beyond gold price |

At the end of the day, choosing gold jewelry as an investment means you appreciate its dual identity. You pay a much higher premium, but in return, you get a beautiful item you can actually use and enjoy.

To get a better handle on valuing a specific piece, our guide explaining how much a gold ring is worth can help you make a much more informed decision.

The Real Pros and Cons of Investing in Gold Jewelry

So, is gold jewelry a smart place to put your money? The answer isn’t a simple yes or no. It’s a unique asset that lives somewhere between a financial holding and a personal treasure, and that duality brings a unique set of pros and cons to the table.

On one side, you get tangible benefits that a gold ETF or stock certificate just can't offer. But on the other, you're dealing with costs and risks that gold bars never have. Let's break down both sides of the coin so you can decide if it aligns with your goals.

The Advantages of Owning Gold Jewelry

The most obvious perk is its double duty. Gold jewelry is a wearable asset—you can actually enjoy its beauty and craftsmanship every single day, all while it acts as a store of value. It's a way to express your style with something that could be worth more down the line.

This leads to another huge plus: its potential as a family heirloom. A beautiful gold piece isn’t just an investment; it's a story you can pass down through generations. Over time, it gains an emotional weight that far surpasses its market price, turning a simple purchase into a meaningful legacy.

And let’s not forget its universal appeal. In so many cultures, gold is the go-to gift for weddings, birthdays, and major milestones, creating a steady, built-in demand that other assets don’t have.

Gold jewelry uniquely combines financial value with aesthetic appeal. Beyond its investment merits, it serves as a wearable art form, allowing investors to enjoy both the financial benefits and the visual pleasure of their investment.

The Disadvantages to Consider

Now for the less glamorous side. The biggest hurdle, by far, is the retail markup. The price tag on a piece of jewelry is always much higher than the actual value of the gold it contains. You’re paying for the craftsmanship, the designer's brand, and the store's overhead. That premium makes it tough to turn a quick profit; you have to wait for the price of gold to climb high enough just to cover your initial cost.

Liquidity can also be a real issue. Selling a gold coin near its spot price is easy. Selling a piece of jewelry? Not so much. Finding a buyer who appreciates the design and is willing to pay a fair price is a challenge. More often than not, you’ll be offered its melt value, which instantly erases any value tied to its artistry or brand.

Finally, there are the practical risks of simply owning it. Gold jewelry is vulnerable to:

Damage: Everyday wear means scratches, dents, and dings. Any damage can chip away at its resale value.

Theft: It’s small, valuable, and portable—a prime target for thieves. Getting the right insurance isn’t just a suggestion; it’s essential.

Fashion Trends: That trendy piece you love today might look dated in a decade, making it a much harder sell to anyone but a gold melter.

Weighing these factors is key. While gold jewelry can be a great investment, it’s best for someone with a long-term outlook who appreciates both its beauty and its financial potential.

How to Buy Gold Jewelry Like a Savvy Investor

Turning your love for beautiful jewelry into a smart financial move means shifting your mindset. You're not just buying a pretty accessory; you're acquiring an asset. It’s about learning to see past the sparkle and focusing on the factors that give a piece real, lasting value.

The first rule? Get as close to pure gold as you can. For an investor, this means leaning into higher karats like 22K or even 24K. Sure, they're softer and less suited for daily wear, but their value is almost entirely tied to the daily spot price of gold. This insulates your investment from the whims of fashion trends.

Focus on Timelessness and Documentation

Beyond gold purity, the design itself is a huge factor in whether a piece holds its value. It's easy to get drawn into trendy, of-the-moment designs, but those can look dated in just a few years. An investor’s eye looks for the classics—simple chains, elegant bangles, or traditional ring designs that have remained desirable for decades.

Just as important is where you buy. Always stick to reputable, well-established jewelers who are transparent and provide all the necessary paperwork.

This documentation is your proof and protection. It should always include:

A certificate of authenticity that details the piece’s specs.

A clear, itemized receipt showing the gold weight, karat, and price.

Any appraisal documents that are available.

Buying from a trusted source with proper certification is your best defense against fakes or misrepresented gold. It creates a clear paper trail that’s essential for insurance and, down the road, for resale.

This paperwork becomes critical when you decide to sell. Once you've made a great purchase, knowing the right places to sell is just as important; you can discover the best platforms for selling valuable collectibles, including vintage jewelry to help maximize your return.

It's also a huge advantage to know how to judge a piece’s worth on your own. For more on that, check out our guide on how to appraise jewelry yourself.

Finally, remember you're stepping into a massive global market. The worldwide gold jewelry market was valued at USD 122.46 billion in 2024 and is expected to keep growing. This powerful, consistent demand is what underpins gold jewelry's reliability as a long-term investment.

So, Should You Invest in Gold Jewelry?

Let's land this plane. Is gold jewelry actually a good investment? The answer isn't a simple yes or no. It’s a unique asset that lives at the intersection of finance, art, and personal expression. If your only goal is to mirror the daily ups and downs of the gold market, then no, it's not a direct substitute for pure gold bullion.

But here’s what it does offer: a tangible, beautiful way to diversify your portfolio. A well-chosen piece can absolutely serve as a hedge against inflation over the long haul, holding its value when paper assets start to feel flimsy. The trick is to buy smart, knowing you’re investing in two things at once: the raw metal and the craftsmanship that shaped it.

Think of your next jewelry purchase less like an accessory and more like a piece of your financial legacy. It’s a rare chance to blend beauty with lasting worth—creating something you can wear today and pass down tomorrow.

When you look at it this way, a simple luxury becomes a strategic, tangible holding. By focusing on timeless designs with high gold content, you’re not just buying something pretty. You’re acquiring an asset that brings personal joy and financial resilience. It’s an investment you can truly wear, admire, and value for years to come.

Common Questions Answered

Even when you've got a plan, a few questions always pop up. Here are some quick answers to the things people ask most, helping clear up the finer points of treating gold jewelry as a real investment.

How Much Is My Gold Jewelry Actually Worth?

This is a great question because your jewelry actually has a few different "values."

First, there's the retail value—what you paid in the store. That price includes everything from the jeweler's rent to the designer’s brand name. Then there’s the appraisal value, which is what an insurer uses. It's usually higher than retail to cover the cost of replacing the piece exactly as it was.

But the true foundation of its worth is its melt value. This is the raw value of the gold itself, based on its weight, purity, and the day's market price. When you go to sell, you’ll likely get a price somewhere between the melt value and the original retail price. Where it lands depends entirely on who’s buying and how desirable the piece is.

Is It Better to Buy New or Second-Hand Jewelry?

For a pure investment, second-hand jewelry is almost always the smarter play. Why? Because the first owner already paid for that big retail markup. You get to buy the piece much closer to its actual gold value.

The catch is that it takes a bit more know-how. You have to be confident in verifying its authenticity, checking the condition, and confirming the gold content. Buying new from a trusted jeweler gives you peace of mind with all the paperwork, but you’re paying a premium for that security.

As an investor, your goal is to get the most gold for your money. Pre-owned pieces usually offer the straightest path to doing just that, letting you skip the steepest part of the retail markup.

What Karat Gold Is Best for an Investment Piece?

The best karat really depends on what you want to do with it.

If you’re looking at it purely as a store of value, 22K or 24K gold is ideal. These pieces are almost pure gold, so their value tracks the gold market much more closely.

The trade-off is durability. Pure gold is soft and scratches easily. If you actually want to wear your investment while it grows in value, 18K is the perfect sweet spot. It has a very high gold content but is strong enough for daily wear. It’s a beautiful balance between a practical accessory and a valuable asset.

At Panther De Luxe Shop, we believe in the timeless power of beautifully crafted gold jewelry. Explore our collection to find a piece that connects your personal style with smart investing.

Comments